What irony

I hate studying Fixed-Income Investments. It's like un-learning everything I learned for Derivatives and re-learning new (and may I add totally different) formulas for the same financial models.

The irony is, both courses share the same textbook -_-.

Textbook and Prof's notes have different formulas for the same thing. And just to study for FI, I created the biggest mess ever on my table. Cross-checking between Derivatives powerpoint slides, FI's notes and Derivatives textbook:

It reminds me of what my uncle said last sem with regards to my table:

"I dunno how you made it to university with this kinda mess on the table."

-_-

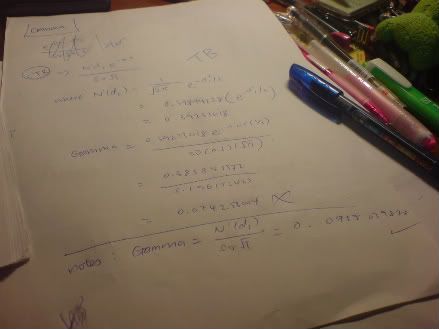

And the best part is, I used both formulas on the same question:

And both had different answers -_- But of course, his formulas resulted in the same answers as his answer keys.

Taking it from Shunhao, who's as butt-itchy as me to take both Derivatives and Fixed Income in the same semester: "Wah Kao! Faintz"

We came to a consensus, we should just use whatever is on his notes. Well, it's his module after all.

If my prof mark me down for any wrong answers due to formula-related errors, I'm gonna throw the notes in his face.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment